59 Maps

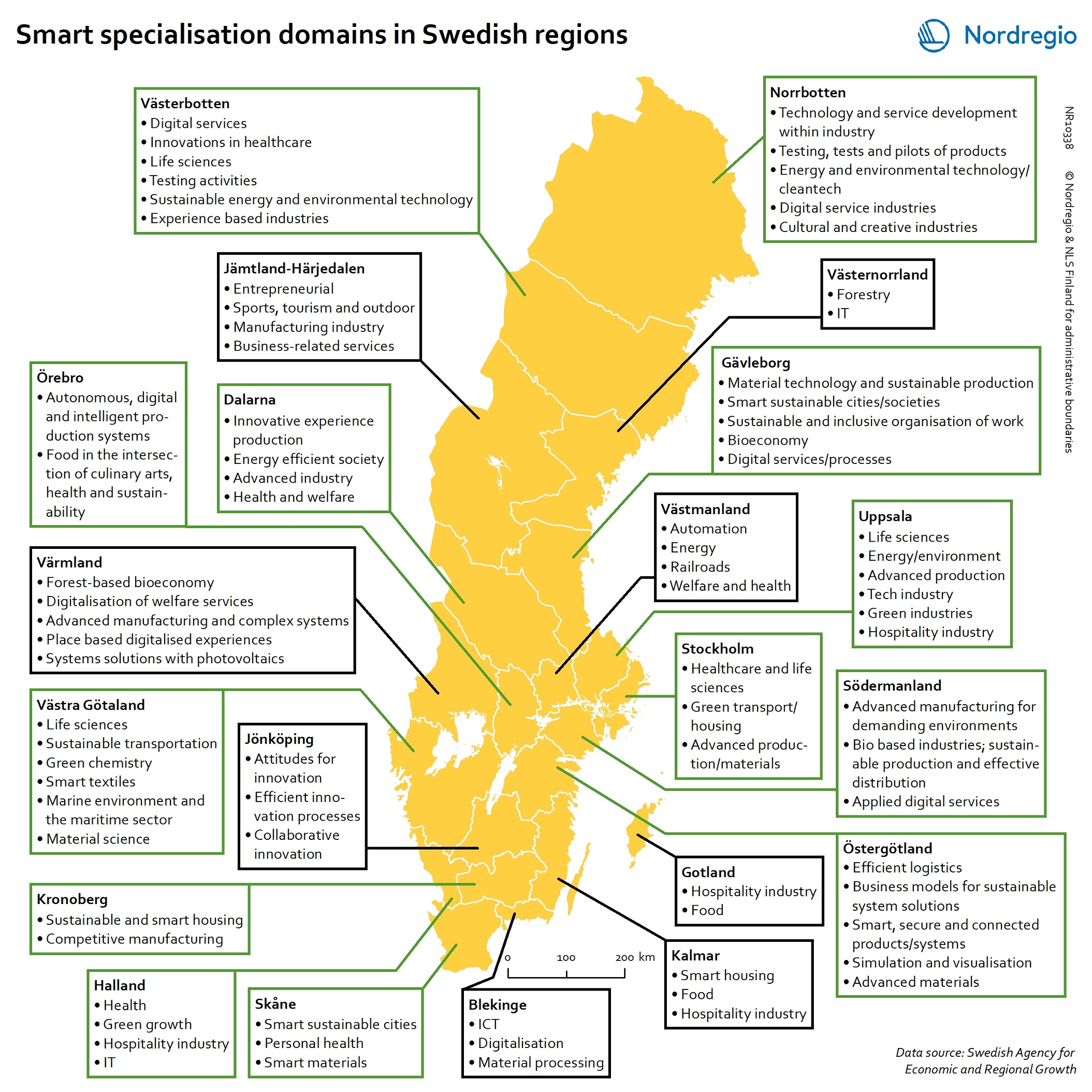

Smart specialisation domains in Swedish regions

This map gives an overview of the S3 focus areas in the Swedish regions in 2019. The major S3 domains in Sweden shown in the map provide a good overview of the key specialisation areas in Sweden. It is possible, for example, to check which Swedish regions have “green”, “sustainable”, “environment” at their smart specialisation domains (marked in green in their respective infoboxes for the domains in the figure). The information illustrated in the map can assist Swedish regions when they are considering opportunities for S3 synergy and co-operation with each other. In Sweden, the Swedish Agency for Economic and Regional Growth (Tillväxtverket) is a central actor in assisting regions in their work with smart specialisation. Tillväxtverket promotes opportunities for cooperation between the Swedish regional S3 processes and provides relevant information and learning seminars related to S3. Read the digital publication here.

2020 February

- Economy

- Research and innovation

- Sweden

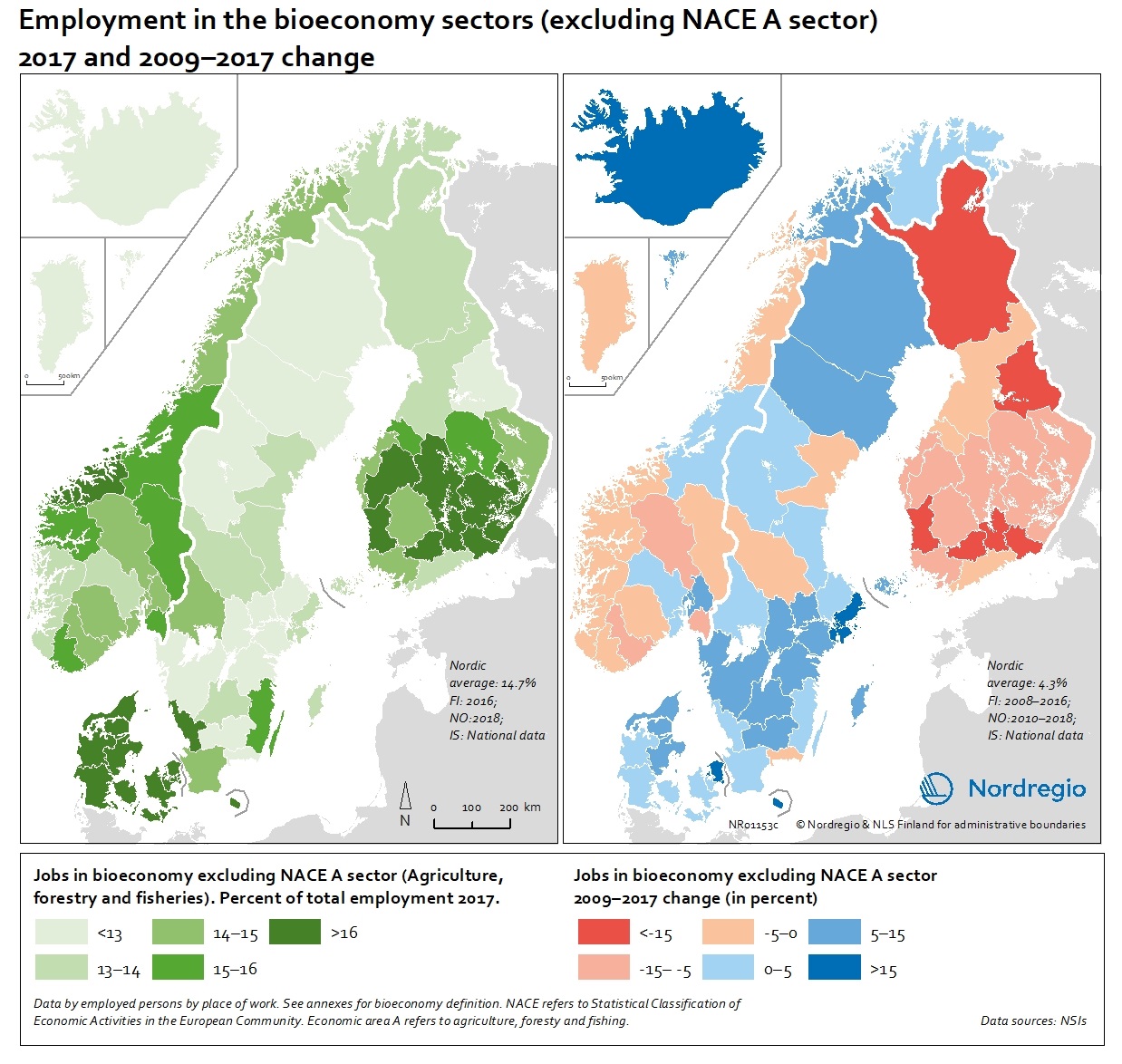

People employed in the bioeconomy excluding NACE sector A in 2017 and 2009-2017 change

These maps show the number of jobs in the bioeconomy sectors as a share of the total employment in 2017 (left) and 2009-2017 change (right), excluding the NACE A sectors. The non-NACE-A sectors have seen a more moderate decrease in Finland but a noticeable increase in most parts of Sweden, Denmark and the Faroe Islands and a remarkable increase in Iceland with more than 15% (Figure 9.3). The average increase in the Nordic Region is 4.3% in the non-NACE-A sectors. There are also notable differences within the countries, showing that regional differences matter. In Denmark, Greenland and the Faroe Islands, there is a positive trend in most regions, but in Finland, almost all regions are losing jobs in the primary industries. In Norway and Sweden, some regions show positive development while others are in decline. Read the digital publication here.

2020 February

- Economy

- Labour force

- Nordic Region

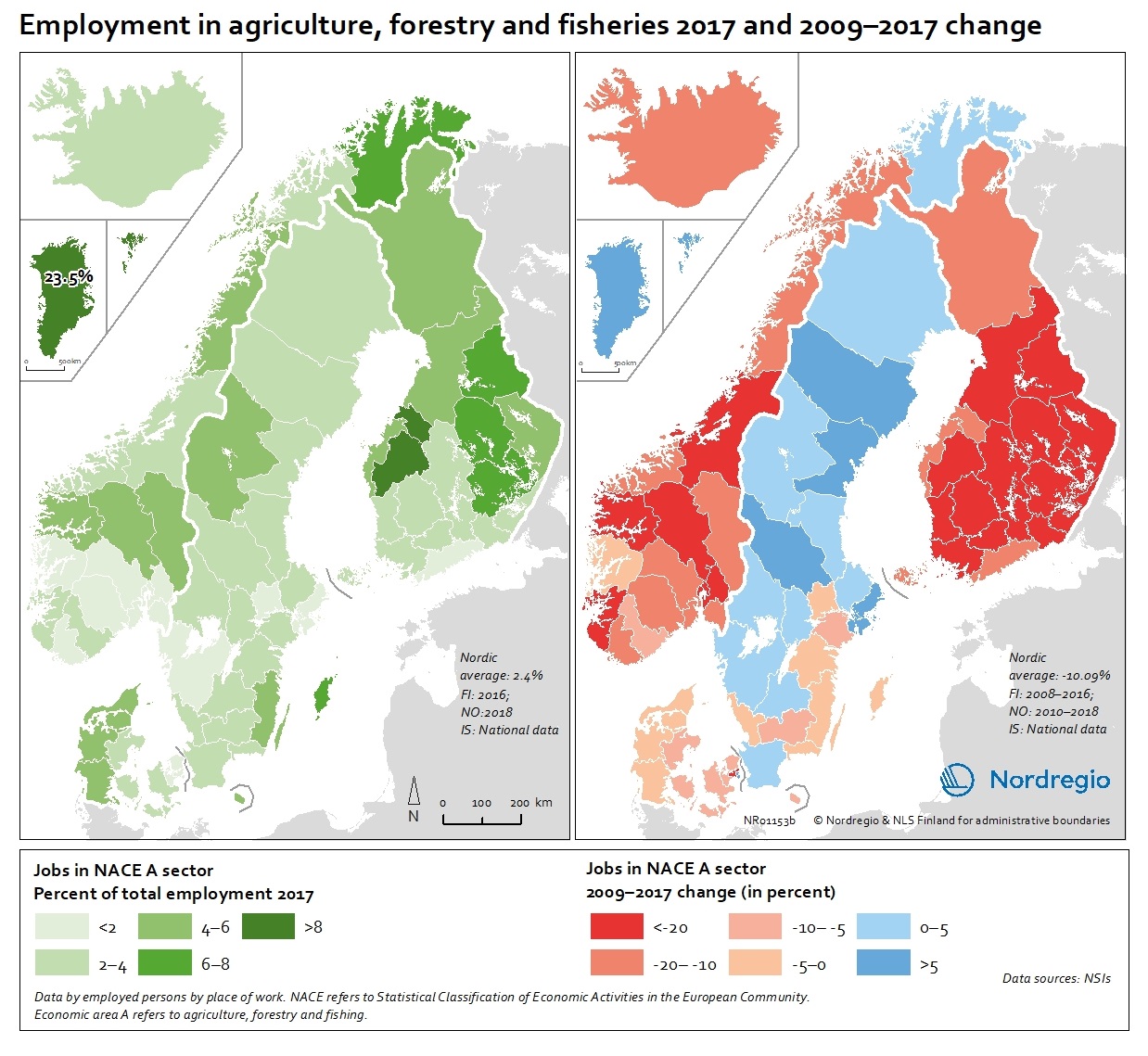

People employed in the agriculture, forestry and fisheries sectors (NACE Sector A) in 2017 and 2009-2017 change

These map show the number of jobs in the agriculture, forestry and fisheries sectors (NACE A sectors) as a share of the total employment in 2017 (left) and 2009-2017 change (right). The map (left) indicates ranges of people employed in agriculture, forestry and fisheries sectors between below 2% to above 8%, with the highest proportion being in Greenland with 23.5% in 2017. In the EU-28, the overall proportion of the total workforce with jobs in the NACE-A sectors is an average of 4.6%. Overall, the NACE-A sectors show a sharp decline in employment (right map), particularly in Finland, Iceland and Norway (except northern Norway), where the decline was up to 20% between 2009 and 2017. Read the digital publication here.

2020 February

- Economy

- Labour force

- Nordic Region

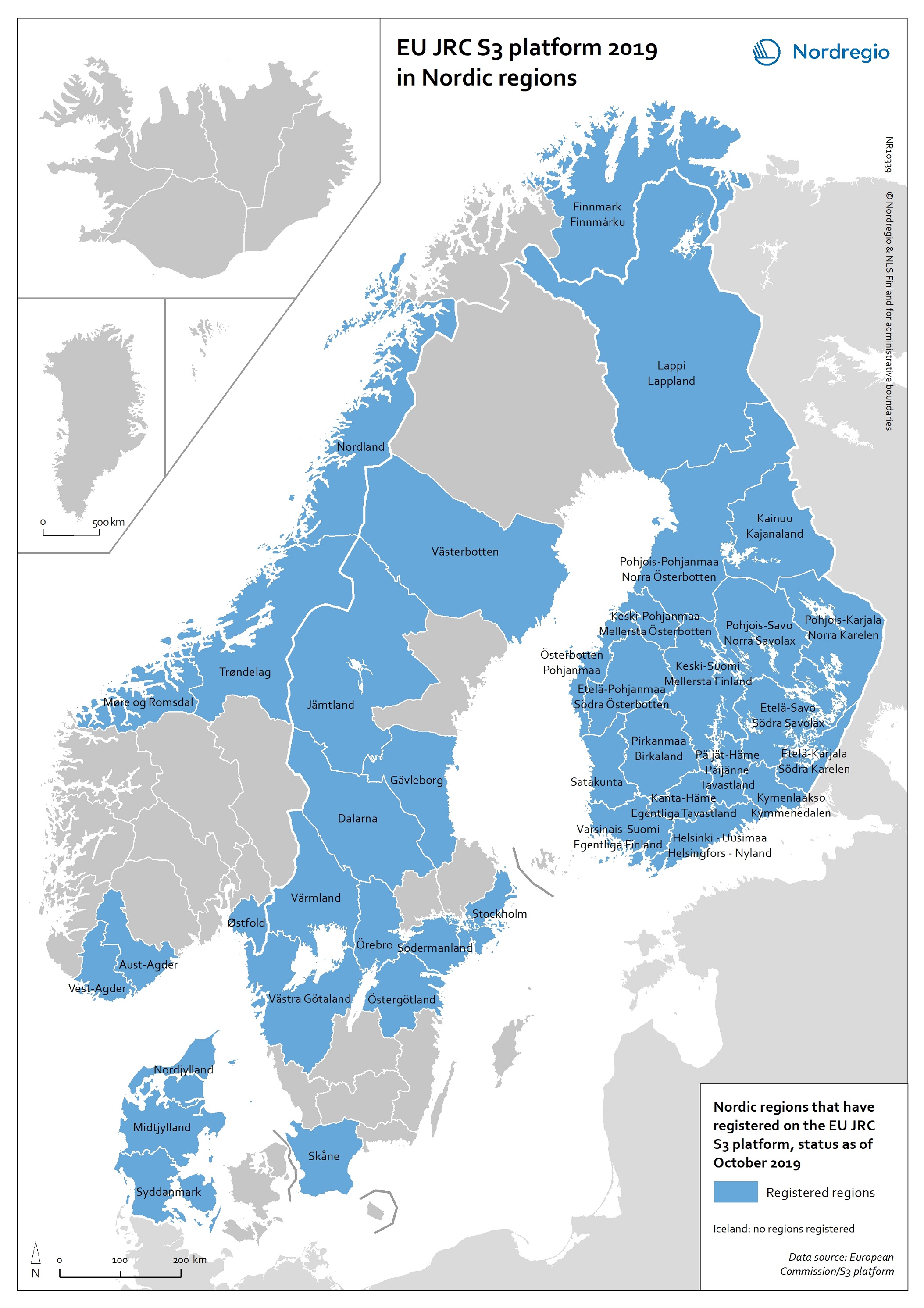

EU JRC S3 Platform 2019 in Nordic regions

This map shows the Nordic Regions that have registered on the EU JRC S3 platform, status as of October 2019. The regions that have registered on the S3 platform receive practical advice and broadened opportunities for international networking. In October 2019, there were 182 EU regions registered on the S3 platform, as well as 18 non-EU Member State regions. Of these regions, 38 are Nordic. It is worth noting that, as a non-EU member state, Norway has seven registered regions on the platform. Registration on the S3 platform is by no means a guarantee of success of a regional smart specialisation process, but it indicates the willingness of the region to learn more about S3 and to participate in international and interregional S3 cooperation through the possibilities provided by the S3 platform. The smart specialisation concept has been diffusing rapidly across Europe in the 2010s, as an increasing number of regions adopt it and design strategies departing from their own preconditions. The S3 platform in Seville, Spain, hosted by the Institute for Prospective Technological Studies (IPTS), was established in 2011 to assist EU countries and regions to develop, implement and review their smart specialisation strategies. The S3 platform provides information, methodologies, expertise and advice to national and regional policymakers, promotes mutual learning and transnational co-operation, and contributes to academic debates around the concept of smart specialisation. Read the digital publication here.

2020 February

- Economy

- Nordic Region

- Research and innovation

People employed in the bioeconomy including NACE sector A in 2017 and 2009-2017 change

These maps show the number of jobs in the bioeconomy sectors as a share of the total employment in 2017 (left) and 2009-2017 change (right). The share of jobs in the bioeconomy varies from below 15% to above 22.5%. For instance, in the western regions of Denmark, the central and southern regions in Finland, Greenland and some mid and northern regions of Norway, over 22.5% of the working population is employed in the bioeconomy. At the same time, most regions in mid-Norway, in all Finnish and some Danish regions witnessed negative development in jobs in the bioeconomy. In Greenland, Iceland, Faroe Islands, Sweden, Northern Norway and other parts of Denmark the situation is very different and the number of jobs in the bioeconomy has increased. These proportions should also be seen in relation to the increase in total number of jobs17 in most regions in the Nordic countries except for the Finnish regions and Åland where there is a decline in most regions. Read the digital publication here.

2020 February

- Economy

- Labour force

- Nordic Region

Regional innovation scoreboard 2019

This map shows the regional innovation scoreboard (RIS) in the European regions in 2019. The small map shows the innovation scoreboard at national level. The index shows the performance of innovation systems, classified into four main performance groups (leader, strong, moderate and modest). The European innovation scoreboard provides a comparative assessment of the research and innovation performance in European countries. It assesses the relative strengths and weaknesses of national innovation systems and helps countries identify areas they need to address. The Regional innovation scoreboard (RIS), a regional extension of the European innovation scoreboard, assesses the innovation performance of European regions on a limited number of indicators. The RIS 2019 covers 238 regions across 23 EU countries, as well as Norway, Serbia and Switzerland. Cyprus, Estonia, Latvia, Luxembourg and Malta are also included at country level. The RIS 2019 is a comparative assessment of regional innovation based on the European innovation scoreboard methodology, using 18 of the latter’s 27 indicators. It provides a more detailed breakdown of the performance groups with contextual data that can be used to analyse and compare structural economic, business and socio-demographic differences between regions. The Nordic regions are doing well in an overall RIS comparison regarding innovation performance. There are, however, considerable differences in innovation performance between the Nordic regions. For example, the capital regions have higher levels of innovation performance than more rural and peripheral regions, according to RIS 2019. This is often due to the critical mass of companies and the spatial significance of the proximity of firms and entrepreneurs, enabling knowledge-sharing and spill-over effects. Read the digital publication here.

2020 February

- Economy

- Europe

- Research and innovation

Higher educational institutions in the Arctic

The map shows universities and other educational institutions on post-secondary and tertiary level located in the Arctic. The red circles indicate a location of a university, college, or campus areas within the Arctic. The size of the circle corresponds to the number of educational institutions in a specific location. There is a high density of educational education institutions around Anchorage (Alaska), in Iceland, the Faroe Islands and the Arctic Fennoscandia (see zoom-in maps). In the Yukon (Canada), the Yukon College is the main educational institution, which has several campus areas across the region. In the Russian Arctic the largest centres with higher educational institutions are in Murmansk, Naryan-Mar (Nenets), Nizhnevartovsk (Khanty-Mansi), Salekhard (Yamalo-Nenets), and Yakutsk (Sakha).

2019 March

- Arctic

- Others

- Research and innovation

Population change in Arctic settlements

The map provides an overview of the population change in Arctic settlements with 500 inhabitants or more during the period 2000 to 2017. The purple underlaying layer shows the extent of permafrost across the Arctic. The circles indicate settlements with 500 inhabitants or more and are proportional to the total population in 2017. Blue tones indicate population growth between 2000 and 2017, while red tones indicate population decline. Four zoomed-in maps show areas with high settlement density – Arctic Fennoscandia, Iceland, the Faroe Islands, and Alaska. In Alaska, population increased in the largest settlements between 2000 and 2017. The population decline in small settlements located far from the two large cities – Anchorage and Fairbanks – has been caused by outmigration, which has cancelled out the positive natural population growth. In the Canadian Arctic, most people live in a few settlements. Similar to Alaska, the population increased in the largest settlements and decreased in small settlements. Most of the smaller settlements in Arctic Fennoscandia have witnessed a population decline between 2000 and 2017, except in Norway. The dominant pattern in Fennoscandia is a population growth in larger settlements and a population decline in surrounding smaller settlements. This is similar to the pattern observed in the other Nordic Arctic countries – Iceland, Greenland, and the Faroe Islands. New inhabitants settled in the capitals (Reykjavik, Nuuk, and Torshavn) and regional centres, from both domestic and international locations, while settlements in sparsely populated areas are becoming less attractive to incomers. In the Russian Arctic, the regions can be divided into the oil and gas areas of the Khanty-Mansi and Yamal-Nenets, and other areas. The population is growing in the oil and gas areas and declining slowly in the others. Over 75% of the settlements have been shrinking throughout the 21st century, mainly because…

2019 March

- Arctic

- Demography

- Migration

Indigenous population in the Arctic

The map shows the indigenous population as a share of the total population in the Arctic. Approximately one million people, or 9% of the total population in the Arctic is indigenous. Indigenous population reassembles more than 40 different ethnic groups. In terms of statistics there are no circumpolar definition of an indigenous person and therefore the number of indigenous people is based on different national definitions. Official statistics do not necessarily recognize indigenous populations separately. The indigenous population is the highest in the Canadian Arctic and in Greenland, weighing more than 75% of the total population. The Yukon, the southern part of Northern Quebec, and Labrador and Newfoundland (Canada) have the lowest shares of indigenous population. In the remaining part of the Arctic, indigenous peoples represent less than half of the total population, except in Sakha (Russian Federation), Southwest Region and Northern Region (Alaska, USA) where 50-75% of the population is indigenous. There are no indigenous people in Iceland, the Faroe Islands and Svalbard.

2019 March

- Arctic

- Demography

Origin of FDI inflows 2003-2016

This map shows the country of origin of Foreign Direct Investment (FDI) in the Nordic regions between 2003 and 2016. The colours indicate different countries of origin of FDI inflow by number of projects between 2003 and 2016. FDI inflows examined by country of origin, reveal an interesting pattern in terms of intra-Nordic investment inflows, confirming the assumption that proximity, both in terms of geographical distance, and in terms of rules, regulation and business culture is an important driver of FDI. A breakdown at the regional level reveals that 55 out of the 74 Nordic regions received the largest number of FDI projects from a region located in another Nordic country. The largest share of these intra-Nordic flows originates from Sweden (35 regions in total), particularly in the manufacturing sector as well as the ICT sector in Norway. The largest share of FDI projects from Finland are attracted to Sweden’s highly competitive international manufacturing industry. Denmark is the main source country of FDI inflows in both Greenland (mostly in the transportation and storage and business services sectors) and the Faroe Islands (mostly manufacturing and finance and insurance activities sectors). Eighteen Nordic regions have their largest source country in terms of project located outside the Nordic Region, i.e. other European and extra-European countries. FDI inflows from other European countries are the highest in terms of projects in six Nordic regions, most of these regions can be characterised by their relative remoteness and strong industrial profile. Finally, two extra-European countries, namely the United States and Canada, are the largest source country in twelve Nordic regions, that are either capital city regions with a strong and diversified service sector or peripheral industrial regions.

2018 December

- Economy

- Nordic Region

Relative local employment effect 2008-2016

The map shows the change in jobs (growth or decline) at municipal level over a period that can be attributed to local factors (e.g. local policies or local natural or institutional conditions) and is thus not due to national or industry trends. The map is based on shift-share analyses which can help answer why employment is growing or declining in a local or regional industry. This type of analysis can answer questions like: How much of local job growth can be attributed to expected national and sectoral trends and how much is due to local factors Is the local economy growing or declining? How does the community compare with other communities? What are the local strengths and weaknesses in providing jobs and in which sectors? What industries are doing well? What industries should be targeted? There are large differences between municipalities in terms of the change in employment due to local factors. For example some of the municipalities in Mid Jutland in Denmark show a high local employment effect while others in the North of Jutland do not. These differences can be due to access to markets, to industrial culture, to municipal or regional facilitation etc. In-depth research is needed in order to understand the reasons. The map does not show the total change in jobs.

2018 June

- Labour force

- Nordic Region

Employment rate 2016 related to the EU2020 goal and 2009-2016 change

This map shows the employment recovery from the financial crisis, with the employment rate (20-64 years) in European regions in 2016 related to the EU2020 goal of 75%, as well as the change in the employment rate between 2009 and 2016. The green colour indicates regions with employment rates above 75% and an increase in the employment rate between 2009 and 2016. The red colour indicates regions with employment rates below 75% and a decrease in the employment rate between 2009 and 2016. The yellow colour indicates regions with employment rates above 75% and a decrease in the employment rate between 2009 and 2016. The blue colour indicates regions with employment rates below 75% and a decrease in the employment rate between 2009 and 2016. The grey colour indicates regions with no data available. On a European scale, the effect of the financial crisis on employment became noticeable from 2009 onwards when average employment rates started to decline. This continued until 2013 when the average European employment rate reached its lowest level of 68.3% for the age group 20–64 years. After 2013 the employment rate started to rise again but it took until 2016 for the average European employment rate to reach and then surpass pre-crisis levels. In 2016 the average employment rate in the European union was 71%, edging closer to the EU2020 goal of 75%. In some regions, primarily in southern Europe, employment rates have still to recover to pre-crisis levels. This is particularly so for Greece, Spain, Italy and Portugal which were particularly hard hit by the debt crisis and thus had to undertake massive cuts across the public sector. On the other hand, some countries such as Germany, Austria and Switzerland saw rising employment rates even during the financial crisis. The differential nature of outcomes in…

2018 February

- Europe

- Labour force

Household access to high capacity fixed broadband 2016

This map shows the household access to high capacity fixed broadband for all Nordic municipalities in 2016. The blue shading indicates the percentage of household with access to high capacity fixed broadband speed of at least 30 mbit/s in 2016. The darker the blue the larger the percentage of household with access to high capacity fixed broadband speed in the municipality, while the brightest colours represent municipalities with a low share. The grey colour indicate municipality with no data. High capacity fixed broadband coverage enhances access to digital solutions in both rural and urban contexts across the Nordic Region, thus making these areas good places to live, work and run a business domestically and across national borders. At a municipal level the household coverage by high capacity fixed broadband shows a more varied picture than that at the regional level. The average figure for Nordic municipalities was 63% in 2016, with more homogeneous figures in Denmark and Sweden than in Norway and Finland. The variation between neighbouring municipalities reflects the decision at the municipal level to prioritise investments in broadband infrastructure development as well as the nurturing of a favourable climate for the establishment of data centres requiring fast broadband networks, among other things. Fifteen Nordic municipalities, located in Sweden and Norway, had already reached the 100% mark for household coverage by high capacity fixed broadband in 2016. In Sweden, these municipalities are located in both the capital city region and in Skåne. In Norway, they are found in the more remote and rural parts of Møre og Romsdal (e.g. Giske), Troms (i.e. Lavangen) and Finnmark regions (Båtsfjord). Municipalities having values above 90% are mostly located in capital city regions as well as in more rural contexts in Jylland (Denmark), southern Sweden and northern Finland and Norway. One explanation for…

2018 February

- Nordic Region

- Others

- Research and innovation

Next Generation Access coverage 2016

This map shows the Next Generation Access (NGA) network coverage in European regions in 2016. The blue shading indicates the percentage of household covered by NGA broadband in European NUTS 3 regions. The darker the blue the larger the percentage of household covered by NGA broadband in the region, while the brightest colours represent regions with a low share. Regions with relatively small territories and important population densities stand out in terms of high NGA network coverage, e.g. urban regions in the Netherlands and Switzerland. Capital city regions also have high NGA network coverage scores, while the more rural regions continue to lag, e.g. in parts of France and Poland. The Nordic countries are characterised by having almost no differences within their territories, i.e. no large variation in terms of NGA network coverage, unlike the clear regional differences in countries such as France or Italy. All regions in the Nordic countries score in the range of 65% to 95% of households having NGA network coverage, except for Etelä-Pohjanmaa in Finland which has a coverage range of 35% to 65% and the Danish statistical region of Østjylland and the capital regions of Denmark and Iceland with scores between 95% and 100% respectively. The relatively high figures for the Nordic Region can in part be explained by the existence of national and regional digitalisation strategies over the last decade or so. In Denmark, as well as in the other Nordic countries, digitalisation has long been on the national agenda. One of the main goals of these strategies has been to increase the growth and productivity of the business community – and to make it easier and cheaper to establish digital infrastructure. The regional level has an important role to play in the development of digital infrastructure, hence the relevance of the elaboration…

2018 February

- Europe

- Others

- Research and innovation

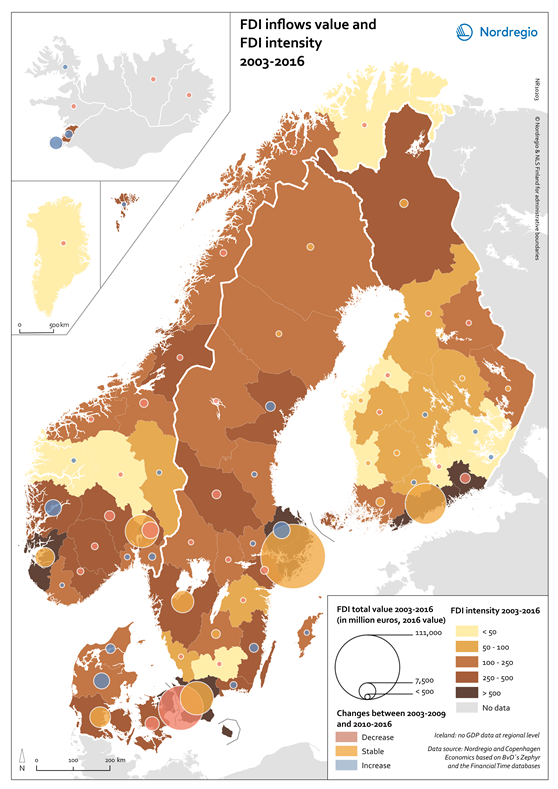

FDI inflows value and FDI intensity 2003-2016

This map shows the total value of Foreign Direct Investment (FDI) in million euros, and the intensity of the FDI in the Nordic regions between 2003 and 2016. The FDI intensity is an index of the value of FDI inflows divided by the gross regional product. The FDI intensity index allows comparing the performance of the Nordic regions in attracting FDI inflows by taking the size of the regional economy into account. A high intensity result reflects a more resilient regional economy, due to a diversity of investors. The brown shading indicates different FDI intensities in the regions between 2003 and 2016. The lighter the shade, the lower the FDI intensity. The grey colour indicates regions with no data. The circles indicate the total value of FDI in million euros (2016 value) in the regions between 2003 and 2016. The larger the circle, the greater the value. The colour in the circles indicate changes in the FDI total value between 2003 and 2016. The pink colour indicates regions with a decrease in the FDI value, the yellow colour indicates stable FDI values, and the blue colour indicates regions with an increase in the FDI value. Large capital city regions tend to be the main beneficiaries of FDI inflows and this pattern is also observed in the Nordic Region. Stockholm region emerges as the clear leader with a total deal value of EUR 110,000m. The Danish capital region attracted about half of Stockholm Region’s deal value – EUR 53,804m followed by Helsinki (EUR 45,000m), Skåne (EUR 30,000m), and Oslo (EUR 29,100m). The total deal value for Reykjavík is rather modest – at around EUR 2,000m, and is comparable to regions such as Dalarna and Jönköping (Sweden), Sør-Trøndelag (Norway) and Lappi (Finland). All Nordic regions have witnessed an increase in FDI inflows…

2018 February

- Economy

- Nordic Region

Life expectancy at birth 2015 and change 2005-2015

This map shows the life expectancy at birth in the regions of Europe in 2015 and the change between 2005 and 2015. The green shading indicates the life expectancy at birth in years in the regions of Europe in 2015. The darker the green the longer the life expectancy at birth. The grey colour indicates regions with no data. The blue circles represent the changes in the life expectancy at birth between 2005 and 2015. The larger the circle, the greater the increase in the life expectancy at birth between 2005 and 2015. As one of the UN Sustainable Development indicators for good health and well-being, life expectancy at birth measures the general health status of a population. Life expectancy at the national level is highly correlated to national income indicators such as GDP per capita. Most of Europe has however reached a level where further increases in wealth no longer increase average life expectancy. The longest life expectancies are found in parts of Spain, France, Italy, Switzerland and Norway. In 2015 there is still a visible East-West divide, where countries in Eastern Europe, in the south-east of the Baltic Sea Region and Northwest Russia have a significantly lower life expectancy. The size of the blue bubbles indicate however that these regions have witnessed the largest increases over the last ten years. If their economies continue to grow it is likely that their life expectancy will continue to increase for some years to come. Regional differences are partly due to individual characteristics, but also to the local environment as well as the politics and institutions that influence the local economy, access to local services and care, general educational levels and the local norms that influence lifestyles.

2018 February

- Demography

- Europe

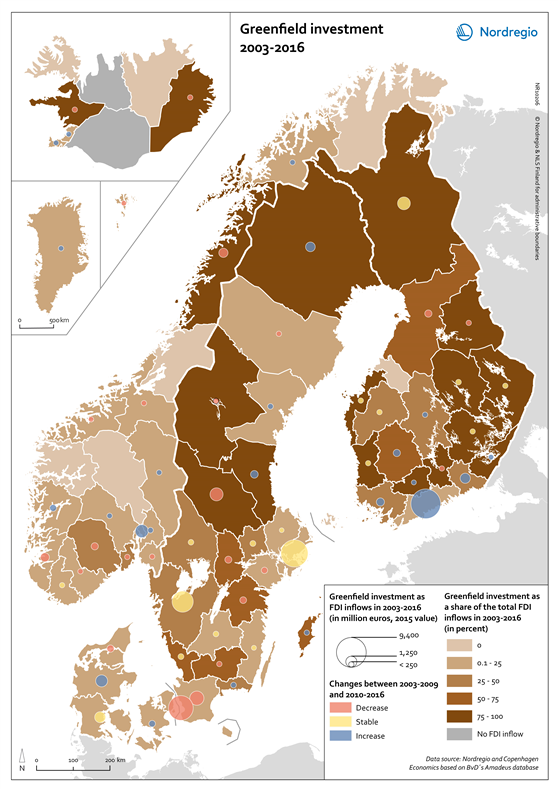

Greenfield investment 2003-2016

This map shows the value of greenfield investment as Foreign Direct Investment (FDI) inflow in million euros, and the greenfield investment as a share of the total FDI inflow in the Nordic regions between 2003 and 2016. Greenfield investments and mergers and acquisitions are fundamentally different forms of FDI, implying that their effect on host economies differs substantially. Consensus does however exist around the notion that the short-term effect should be greater when a foreign company’s penetration occurs through greenfield investment. The brown shading indicates different shares of greenfield investment related to the total FDI inflows in the regions between 2003 and 2016. The lighter the shade, the lower the share of the greenfield. The grey colour indicates regions with no FDI inflow data. The circles indicate the greenfield investment in million euros (2015 value) in the regions between 2003 and 2016. The larger the circle, the greater the value. The colour in the circles indicate changes in the greenfield investment between 2003 and 2016. The blue colour indicates an increase in deal value in the second period (>60% of the inflows of 2003–2016 took place in 2010–2016), yellow indicates a stable value in inflows between the two periods (40–60% of the inflows of 2003– 2016 took place in 2010–2016), while red indicates a decrease over time between the two periods (<40% of the inflows of 2003–2016 took place in 2010–2016). Examined by regions with the largest share of greenfield investment during the period 2003–2016, the administrative regions of Helsinki (EUR 9,402m), Stockholm (EUR 7,896m) and Copenhagen (EUR 6,601m) emerge as Nordic leaders in attracting this form of foreign investment. Due to their innovation-based economies and booming start-up scenes, both Västra Götaland and Skåne (Sweden) have also performed exceptionally well in attracting greenfield investment securing deal value totals of EUR…

2018 February

- Economy

- Nordic Region

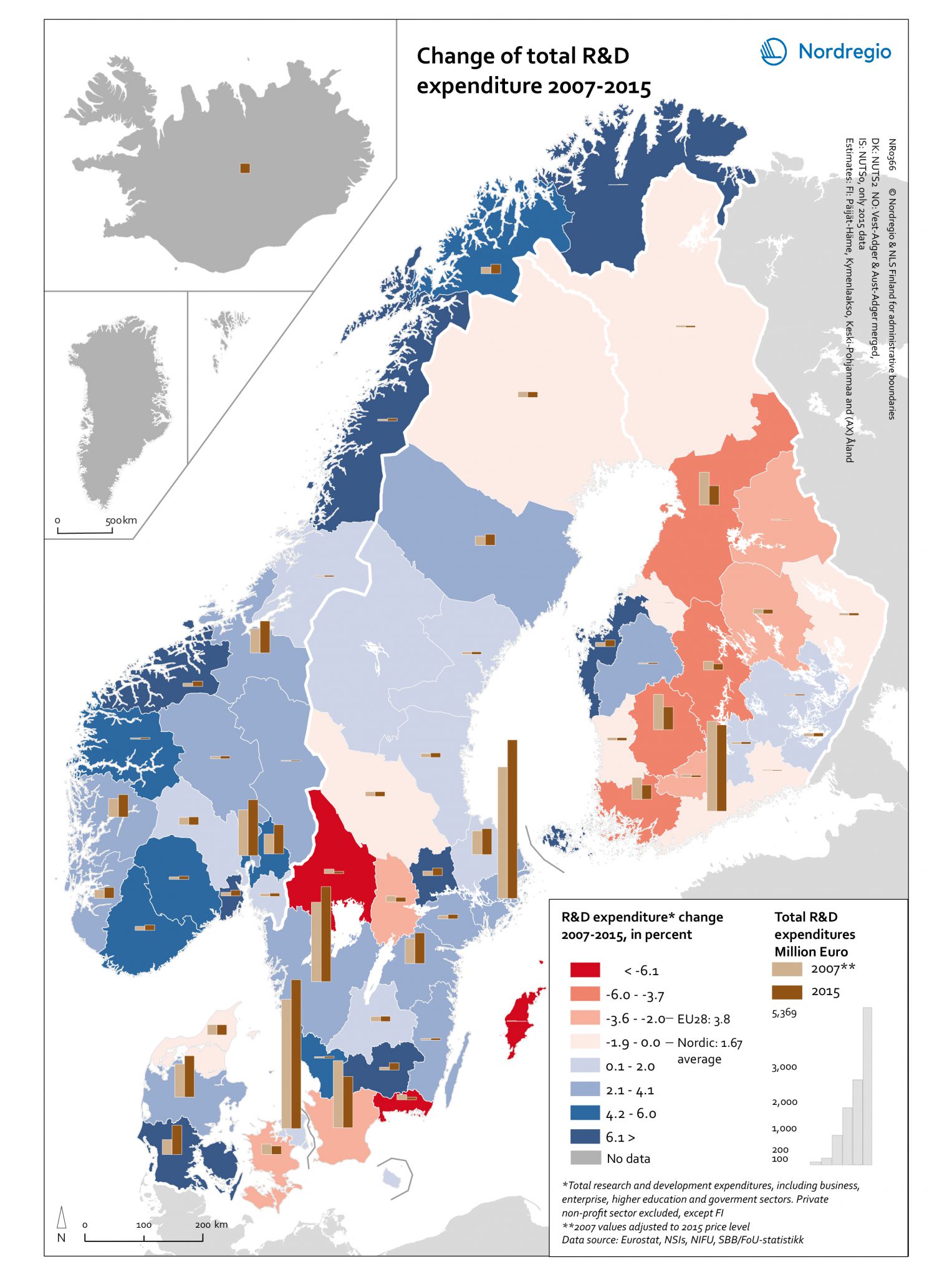

Change of total R&D expenditure 2007-2015

This map shows the change in the expenditure in research and development (R&D) between 2007 and 2015 in the Nordic Region. The blue tones indicate regions with a positive change in the R&D expenditure between 2007 and 2015. The red tones indicate regions with a negative change in the R&D expenditure between 2007 and 2015. The darker the colour, the stronger the change. The grey colour indicates no data. The bars indicate the value of expenditure in R&D in million euros, the light brown for 2007 and the dark brown for 2015. The values of 2007 expenditures were adjusted to 2015 price level. High levels of Research and Development (R&D) expenditure are viewed as a vital enabling factor for innovation which is one of the key policy components of the Europe 2020 Strategy. At the regional level in Finland, most regions have shown a downward trend in R&D expenditures both in percentage and in real terms. This reflects the challenging fiscal policy and economic conditions experienced in Finland after the global financial crisis in 2008 and the difficulties faced by the ICT sector, where R&D is highly concentrated, as well as the inability of other industries to compensate for the decline of the ICT sector. Åland on the other hand has shown a positive trend in R&D expenditures, although having very low values in absolute numbers for both years. Sweden has experienced a dramatic decrease (< -6.1%) in R&D expenditures in Värmland, Blekinge and Gotland which was in large part, if not entirely, caused by the relocation of important R&D facilities/resources. Similarly, some major closures and redundancy notifications led to substantial cuts in R&D spending in Skåne in 2015, despite the increasing number of start-ups. For Iceland, available data for the 2013–2016 period indicates a steady and stable increase in…

2018 February

- Economy

- Nordic Region

- Research and innovation

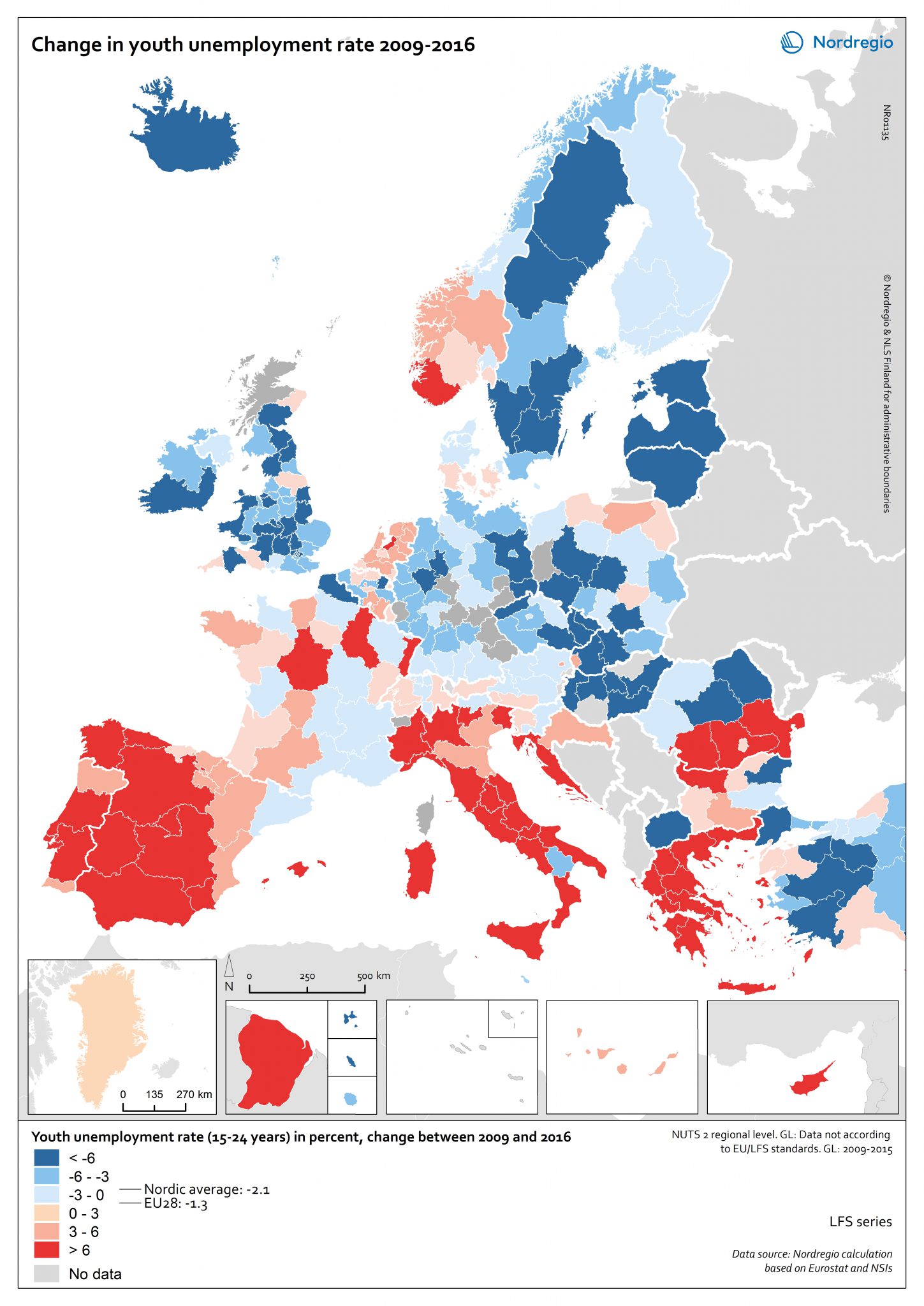

Change in youth unemployment rate 2009-2016

This map shows the change in youth unemployment rate (15-24 years) between 2009 and 2016 in the European continent. The red tones indicate regions with positive change in the youth unemployment rates between 2009 and 2016. The blue tones indicate regions with negative change in the youth unemployment rates between 2009 and 2016. The darker the colour, the highest/lowest change in the youth unemployment rate. The grey colour indicates regions with no data available. Young people are more likely to experience labour market disadvantage due to their relative lack of experience. In many European countries, recovery from the 2008 crisis is an ongoing process that continues to have a serious impact on young people’s participation in economic and social life. In a European comparative perspective, the Nordic countries have bounced back fairly well overall, though some variation between the countries is evident. In Sweden, Iceland and Finland, all regions have experienced at least some decrease in the youth unemployment rate, with the most substantial drops observed in Sweden. In some regions in Norway and Denmark however, the youth unemployment rate was higher in 2016 than in 2009. It is important to consider the recovery evident in the context of the current youth unemployment rate.

2018 February

- Europe

- Labour force